As you may be aware, the IRS has extended the Employee Retention Credit (ERC) through 2021 for eligible employers. These credits are required to be included on your 941 quarterly employment tax return for any quarter in 2021 in which your company took the credits. Since Alliance HCM files your 941’s each quarter, the following ERC information is critically important. Here is what we request you do now:

- If you are NOT utilizing Employee Retention Credits in 2021, you do not need to take any further action.

- If you are using Alliance HCM to manage your 2021 Employee Retention Credits, you do not need to take any further action. Alliance will take full responsibility in calculating and filing your credits, as well as including them on your 941's - which we already file for you.

- If you are using an outside firm to manage your credits, or you are calculating the credits yourself, it is critical that you inform us of the amounts that will need to be included on your 941's:

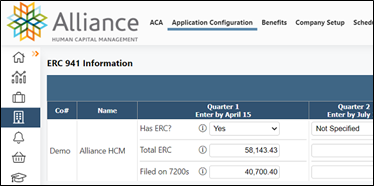

- In your Alliance AllPay software, go to the Company » Application Configuration » ERC 941 Info tab (see following image).

- Choose “Yes” in the “Has ERC?” box for any 2021 quarters in which you are taking ERC and “No” if you are not taking the credit for a particular quarter.

- A "Yes" response will tell us NOT to file your 941 until you have entered the appropriate ERC data.

- A "No" response will tell us that we are clear to run the 941 for that particular quarter.

- After you have calculated the wages to use for ERC for each quarter and filed all of your form 7200's for the quarter (7200's are optional), enter the amounts of Total ERC and the amount Filed on 7200's in the appropriate boxes provided for the appropriate quarter. These amounts will appear on your 941.

- Please ensure that the appropriate ERC amounts are posted in your AllPay software by the 15th of the month following the end of the quarter.

The Employee Retention Credit program allows extremely generous tax credits for eligible employers, even for those with PPP Loans. We at Alliance HCM will be happy to give your company a free ERC analysis to see if you are eligible. If you would like Alliance HCM to assist you in determining your eligibility and maximizing your Employer Retention Credit, please send an email to erc@alliancehcm.com. We have also included some additional information about the Alliance HCM ERC program that you can find here.