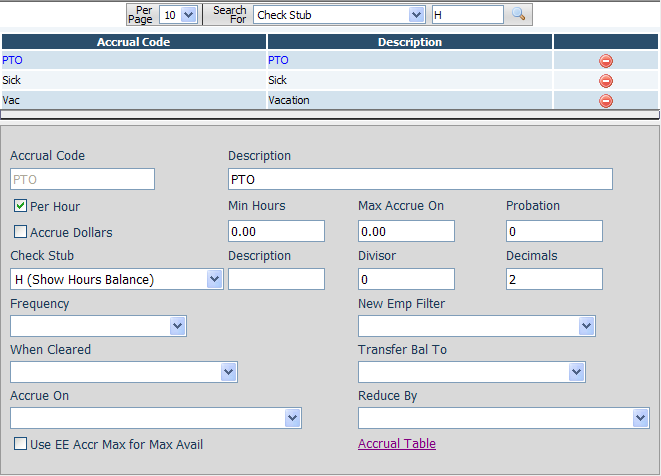

Accrual Setup

Overview

This page provides the company setup for employee accruals/time off codes, including the Accrual Table that defines the accrual rates and maximums in effect based on employee length of service.

Fields

• Accrual Code – The accrual code for the item.

• Description – The description of the accrual. This is what will appear on employee check stubs (if this accrual type is displayed on check stubs).

• Per Hour – Indicates that the accrual is an hours-based accrual and accrues based on the number of hours an employee works instead of being a frequency-based accrual that accrues a certain number of hours in a given time period.

• Accrue Dollars – Indicates that the accrual accrues dollars instead of hours.

• Min Hours – This is for hours-based accruals only. This indicates the minimum number of hours an employee must work in a pay period to be eligible for the accrual.

• Max Accrue On – This is for hours-based accruals only. This indicates the maximum number of hours that will be used in a single pay period for the purposes of calculating the number of hours to accrue.

• Probation – The number of days an employee must work before any accrued or used amounts will affect the employee’s balance. The employee will accrue time during this time period but the employee’s balance on the Time Off page will not be changed by the system. During the first payroll processing after an employee comes out of probation, the balances will become visible.

• Check Stub – Defines whether or not the accrual is displayed on employee check stubs. It also specifies whether to show hours only, dollars only or both hours and dollars.

• Check Stub Description – The description of the accrual to display on the check stub.

• Divisor – When the accrual is displayed on the check, it will first be divided by this number. This allows you to show days instead of hours on the check. For a typical 8 hour day, you would enter the number 8 here.

• Decimals – Defines the number of decimals of the available balance to show on the check stub.

• Frequency – Defines how often the frequency-based accrual should accrue. For hours-based accruals, leave this blank.

• New Emp Filter – When specified, this group of employees will automatically have this type of accrual added to them (if they do not have one already) during each payroll processing.

• When Cleared – For accruals that clear out on an annual basis, choose when the accrual should clear.

• Transfer Bal To – During the accrual clearing process, this specifies another accrual code to which the cleared balance is transferred. All or partial amounts can be transferred according to the applicable Accrual Table entry for the employee whose balance is being cleared.

• Accrue On – This is for hours-based accrual only. This defines which earning or code group to use as the basis for the number of hours worked during a pay period.

• Reduce By – Defines which earning code or codes reduce the employee accrual balance for this type of accrual.

• Use EE Accr Max for Max Avail – The accrual’s Accrual Table defines a Maximum value for the accrual. When this box is not checked the Maximum value refers to the total of the accrual which is defined as Available plus Used. When this box checked the Maximum value instead refers to the employee’s current Available balance

Accrual

Table

Accrual

Table