401(k)

Overview

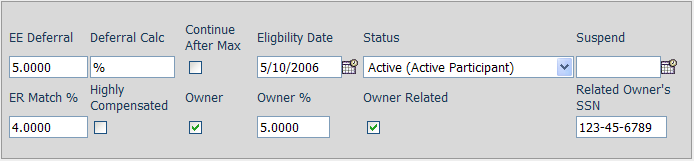

This page contains information regarding the employee’s 401(k). This information is generally used either for informational purposes or for producing files to send to your 401(k) company, especially end of year census and compliance testing files. Since this information is not generally used for the purposes of calculating an employee’s 401(k) deduction, Alliance Payroll can create a customized 401(k) or 401(k) match calculation that utilizes this information.

Fields

• EE Deferral – The employee’s deferral percentage or amount.

• Deferral Calc – The calculation method for employee deferrals.

• Continue After Max – Indicates if the employee should continue contributing after reaching the 401(k) gross maximum for the year.

• Eligibility Date – The date on which the employee became or will become eligible to participate in the 401(k) plan.

• Status – The employee’s current 401(k) status.

• Suspend – The date on which the employee entered or will enter a 401(k) suspension.

• ER Match % – The percentage at which the company match is calculated for the employee.

• Highly Compensated – Indicates if the employee is highly compensated with respect to 401(k) rules.

• Owner – Indicates if the employee is an owner of the company.

• Owner % – The percentage of the company the owner owns.

• Owner Related – Indicates if the employee is related to an owner of the company.

• Related Owner’s SSN – The SSN of the related owner.