Agencies

Overview

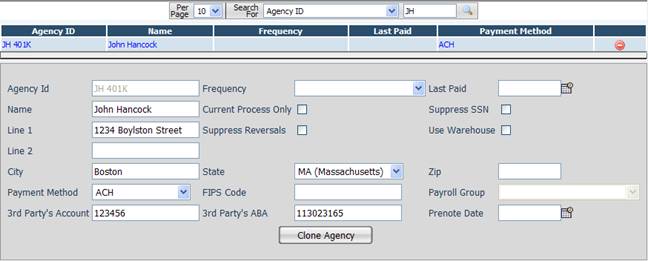

The Agencies page defines the third party payees that are available in the system. Employee deductions and well as company-wide earnings and deductions can be assigned an agency. Any monies deducted, in the case of employee or company-wide deductions, or earned, in the case of company-wide earnings, are added to the agency and a check is cut according or an ACH payment is made according to the Frequency setting on this agency setup.

Agency Id Sharing

An agency Id represents a payment, if multiple employee deductions are given the same agency they will be lumped together on the same payment. Sometimes this is desired, sometimes it is not. For instance 401k payments probably should all be lumped into the same agency code while child support and garnishment payments typically need to have separate payments for each child support. If multiple employees have child support payments for the same child support agency it is necessary to set up the agency multiple times from the Agencies page. A Clone Agency button has been provided to make the process of setting up copies of agency easy as quick.

Fields

• Agency Id – The identifying Id number assigned to this agency. This can be up to 10 characters in length.

• Name – The name of the payee for this agency. This is the name that will be printed on checks or included on the ACH transaction.

• Address – The address of the payee that is printed on the check.

• Frequency – The frequency to pay the agency. If left blank agency payments are made during the same payroll process as they are recorded.

• Current Process Only – When checked the system will only consider items recorded on the current processing for purposes of calculating payment amounts. If unchecked the system goes back through all recorded payroll items that were allocated to the agency that have not yet been included on a check and totals them up to calculate the amount of the payment.

• Suppress Reversals – When checked the system will not include negative payroll items when calculating the amount of the agency payment.

• Last Paid – For items with a Frequency other than blank this date is filled in by the system when agency payments are made. This date is then used by the system to calculate the date of the next agency payment.

• Suppress SSN – When checked the employee’s SSN is suppressed from the check stub.

• Use Warehouse – When checked the system will not actually make any payments for the item. Instead it will only record the item for tracking purposes.

• Payment Method – The method with which to pay the agency.

• FIPS Code – The FIPS code to use for the transaction, for ACH-Agency Payment Methods only.

• Payroll Group – The payroll group that the agency item applies to, for ACH-Agency Payment Methods only.

• 3rd Party’s Account – For ACH items only, this is the account number where the ACH payments should be made.

• 3rd Party’s ABA – For ACH items only, this is the ABA / transit number where the ACH payments should be made.

• Prenote Date – For ACH items only, this is the prenote date of the ACH item. If you wish to skip the pre-note date enter a date at least weeks in the past.

Cloning / Copying an Agency

To create a copy of an agency under a new Id number first select the desired agency from the list and then press the Clone Agency button. The system will prompt you to enter an Id for the new agency and will then set up a copy of the currently selected agency.