Taxes

Overview

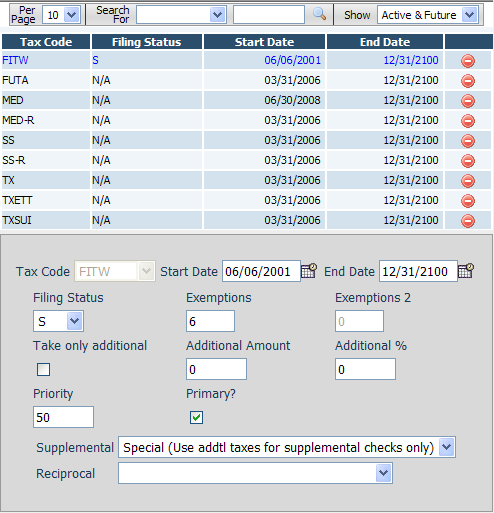

Both taxes to be deducted from an employee’s paycheck and employer taxes are maintained on this page.

Fields

• Tax Code – The tax code for this tax.

• Start Date – The date on which the tax will begin. If left blank, the begin date will default to today’s date.

• End Date – The date on which the tax will end. If left blank, the end date will default to 12/31/2100 (forever).

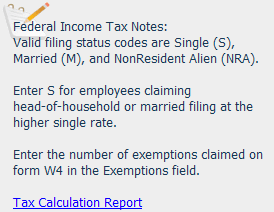

• Filing Status – The filing status code for this tax. Each tax has its own list of valid status codes. Notes that explain the various options for the selected tax are shown at the bottom of this screen.

• Exemptions – Typically this will be the number of exemptions claimed on the W4 or state W4. See the tax notes at the bottom of the page for details on what to put in this column.

• Exemptions 2 – The exemptions #2 if applicable to this tax. See the on-screen notes for an explanation. This field will be disabled if it does not apply to the tax.

• Take only additional – Indicates to make the system use the override amount and/or percentage as the sole basis for the tax calculation. For instance, if an employee is filing with an exempt status from FITW tax, the correct way to block the tax is to check this box and enter a zero in the Additional % and Additional Amount fields.

• Additional % – The additional percentage to withhold for the tax.

• Additional Amount – The additional amount to withhold for the tax.

• Priority – The priority number for the tax. This tells the system in which order to calculate the taxes, which may be important in a shortage situation. You will generally not need to change this number from the system assigned value.

• Primary? – When an employee has multiple state taxes set up, this check box indicates which is the primary state.

• Reciprocal – The reciprocal code for this tax. This only applies to employees who have multiple state taxes set up.

Notes Section

At the bottom of the screen is a notes section which provides import details about the appropriate information to enter into filing status and exemptions fields of the selected tax.

A ‘Tax Calculation Report’ link is provided, when clicked the system will generate a report showing you the exact formula that is used when the selected tax is calculated.