Check Attributes

Overview

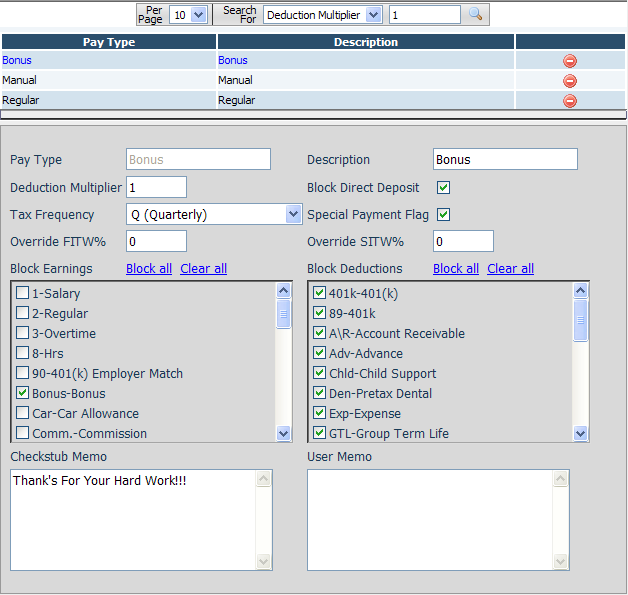

The Company Check Attributes page allows you to predefine and customize named sets of properties for paychecks. This is commonly referred to as the Check Type, Pay Type or Check Attributes of a paycheck.

The type of check can be configured as a default for an entire payroll batch by changing the Default Check Type from the Batch Options. A single check can be configured to use a different set of attributes by changing the Check Type on the Employee Pay Entry page.

In addition each check can have its own custom check attributes applied as an override by clicking the Edit Check Attributes link on the check.

Fields

• Pay Type – The short name of the Pay/Check type being defined.

• Description – A description of the pay type.

• Deduction Multiplier – If other than zero or one this will cause deductions on checks with this pay type to be multiplied by this number.

• Block Direct Deposit – If checked this causes checks with this pay type will not have direct deposits applied and only live checks will be produced.

• Tax Frequency – The tax frequency that will be used when calculating taxes on check with this pay type.

• Special Payment Flag – Indicates that the check should be calculated as a bonus or special payment as defined by IRS guidelines. There are two other settings in the system that are used in conjunction with this setting.

o Employee Taxes – The Supplemental setting on the FITW and certain other state income taxes defines whether or not to use the supplemental tax rate for this employee and whether to take additional amounts set up on the tax in addition to the supplemental rate or not.

o Employee Direct Deposits – The Exclude Special Checks check box allows the system to automatically block direct deposits on an employee by employee basis for checks that have the Special Payment Flag.

• Override FITW % - Specifies an override tax percentage to use when calculating federal income tax withholdings (FITW).

• Override SITW % - Specifies an override tax percentage to use when calculating state income taxes withholdings (SITW).

• Block Earnings – Defines which calculated earnings, if any, should be blocked from the check. Note that this only blocks earnings that are set up as recurring items on the Fringe page, earnings that are calculated by scripts such as 401k match may calculate even if they are set to block here. In addition items that are listed as line items on a check cannot be blocked by this setting.

• Block Deductions – Defines which calculated deductions, if any, should be blocked from the check. Note that this only blocks deductions that are set up as recurring items on the Deduction or Insurance pages, any deductions that are calculated by custom may calculate even if they are set to block here. In addition items that are listed as line items on a check cannot be blocked by this setting.

• Checkstub Memo – The memo that will display on the printed pay stub for checks that are paid under this check type.

• User Memo – The memo that will be recorded on the check as a history item only. Note that the user memo does not print on our standard check stubs. This field is rarely used but it can be utilized for instance to provide a way to make notes about why a check may have been paid a certain way for audit purposes. It is possible to produce reports that contain the user memo on them.